VISIONARY ACCOUNTANTS, TAX AGENTS & WORKFORCE ADVISERS

FOR INCOMPARABLE PERSONAL & CORPORATE OUTCOMES

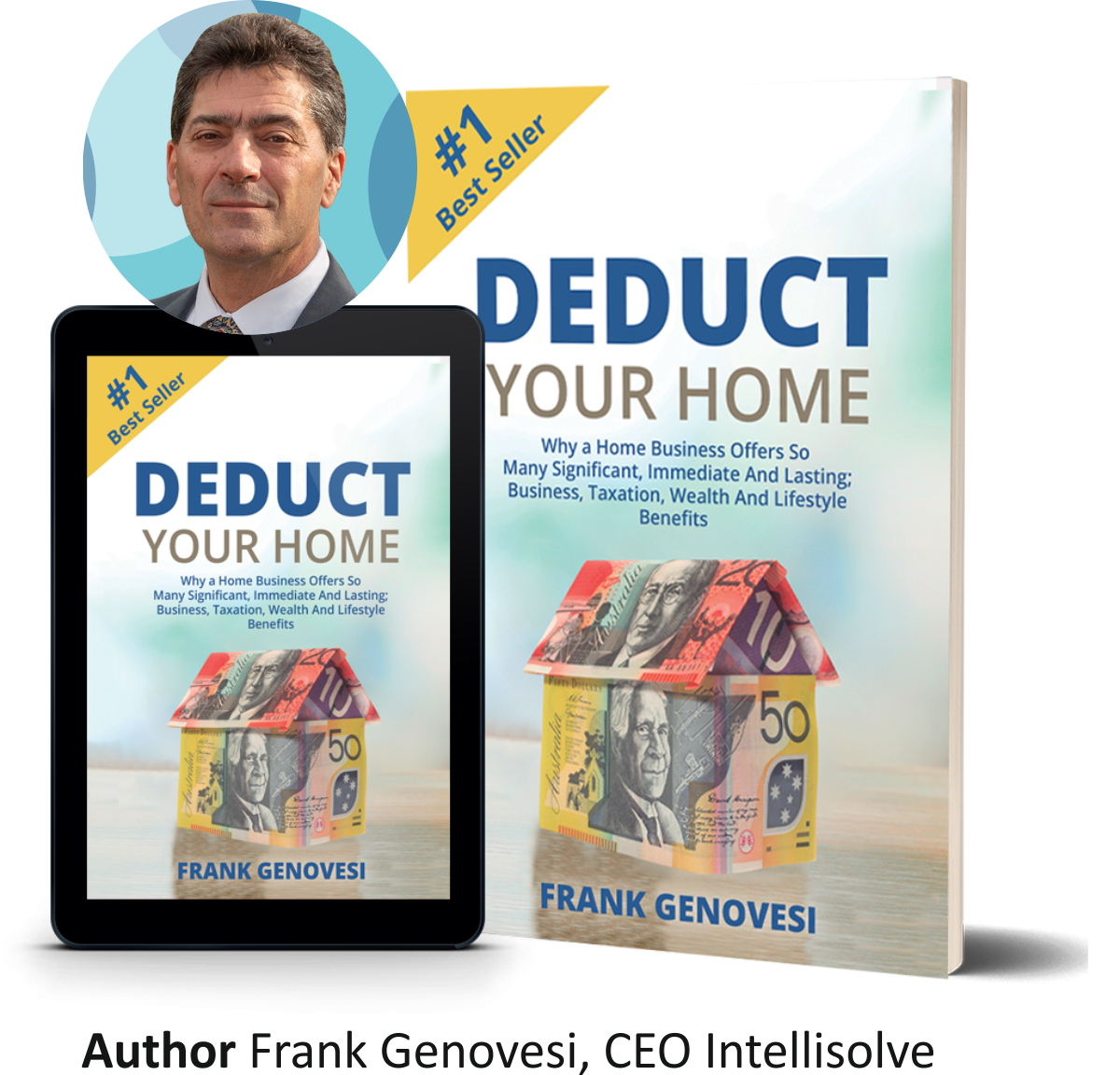

Home Owner Benefits: Our ATO vetted proprietary strategies deliver up to 100% tax deductibilty on your mortgage interest plus a hefty tax deduction on other home related costs, without capital gains tax dramas at sale! What will you do with the savings?

Employer Benefits (SME's and Listed Companies): Reduce Costs --- Gain Market Edge --- Mitigate Business Risk --- Attract & Retain the BEST Workers

Vastly improving the financial health and lifestyle of your workforce is crucial to growing your business. In collaboration with your executive/advisory team, our ATO acknowledged IP typically cuts $10K - $30K p.a. per worker from your payroll and related costs.

The ATO has confirmed our specialist fee as fully tax-deductible and FBT free. It's also covered by your first year's savings and, you get 95% ROI p.a. thereafter!

We're Australia's future-focussed, reputable, regulator-vetted and peerless, business builders and life improvers ... Nothing Compares!